Is your collector resume struggling to collect interviews? Time to turn the tables! Our article offers expert guidance to help you create a resume that stands out like a gold coin in a pile of pennies.

With our help, you'll be fielding job offers left and right.

One of our users, Pam, had this to say:

Zety is well worth the money! All you do is input your info and Zety turns it into a professional resume that appears like you took hours to make.

Looking for other finance jobs? See these guides:

Sample Debt Collector Resume (Text Version) Jeff Bradley

Debt Collector

918-760-9971

jeffzbradley@gmail.com

linkedin.com/in/jeffzbradley

twitter.com/jeffzbradley

Effective debt collector with 4+ years of experience in negotiating and payment processing. Seeking to speed repayment of outstanding debts owed to Drive Credible. At Zap Asset, processed 160+ calls a day with 12% higher success rate than company average.

Experience

Debt Collector

Zap Asset

July 2018 to Jan 2020

Key Qualifications & Responsibilities

Performed first party collections by making at least 70 calls per day on an automated dialer. Fielded 170–200 calls daily. Assisted borrowers over the phone via 3rd party to negotiate repayments. Exceeded monthly goal with over $35,000 collected per month. Helped customers with money management and payment plans. Key Achievement:

Awarded annual bonus for meeting 100% of financial goals in 2018 and 2019. Debt Collector

Summit Cash

Aug 2016 to June 2018

Handled claims from all 50 states and applied specific state laws and rules. Supervised a group of more than 15 collectors. Followed strict guidelines providing 100% customer service. Managed a file of over 3,000 delinquent medical accounts. Call Center Agent

Arise Balance

July 2015 to July 2016

Fielded 120–140 inbound calls daily in a busy parts department. Maintained monthly quality control average of 95%. Made recommendations according to customer needs. Education

Associate Degree in Communication

University of Oklahoma

2011-2015

Pursued a passion for mass communications. Used interpersonal skills to grow attendance in the school cycling club 30%. Skills

Documentation Negotiating Needs Analysis Payment Processing Attention To Detail Listening Communication Time Management Member, National Communication Association

Helped arrange inter-university speech competition. Recruited 15+ volunteers for multiple events. Freelance

Worked on personal freelance projects for 20+ customers. Provided voice-over for a local TV ad. Here’s how to write a collector resume step-by-step.

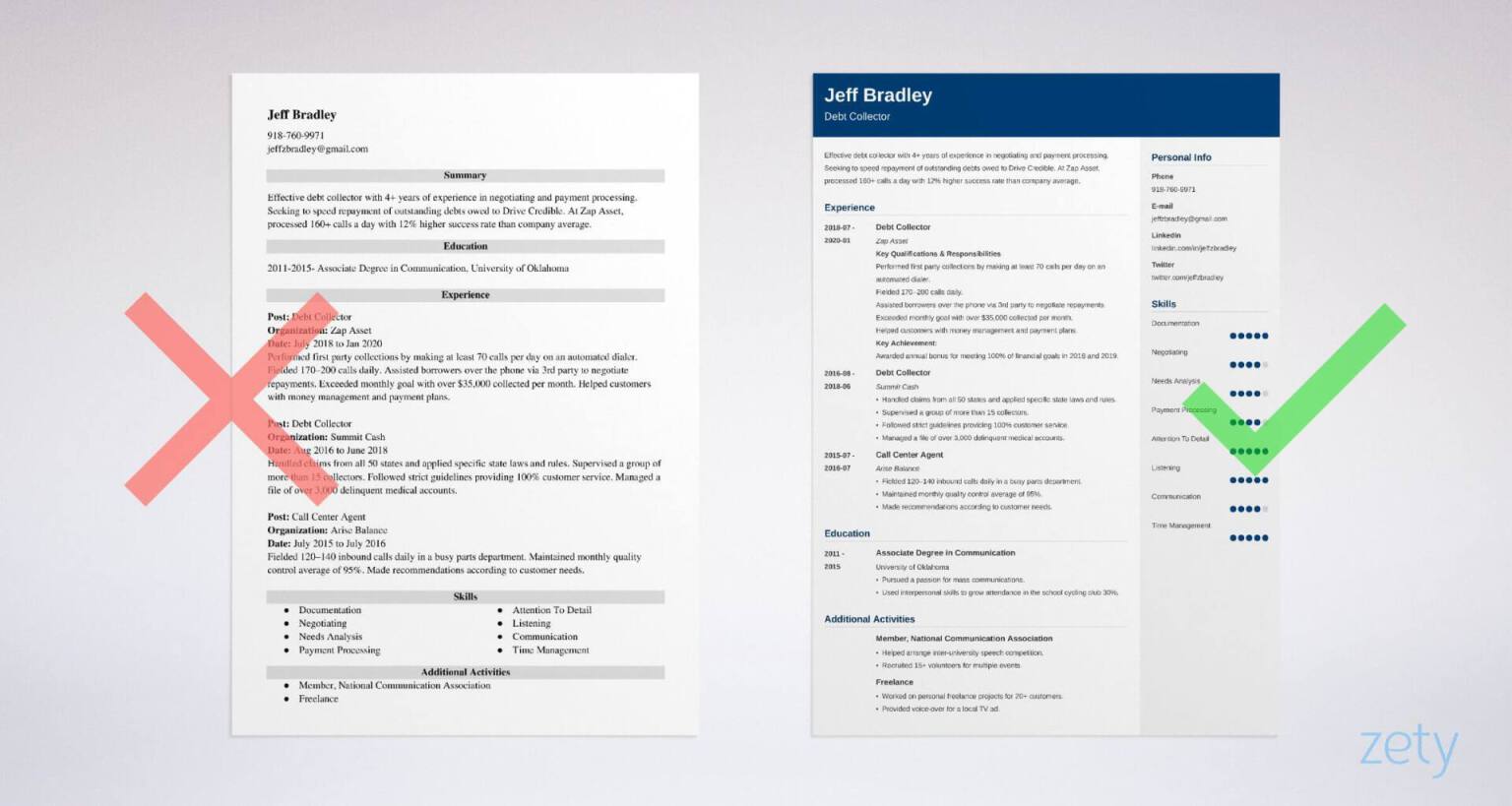

1. Start With the Right Format for a Debt Collector Resume The wrong debt collector resume format can break your job search from the start. That’s because each bill collector job opening gets 150+ applications. You have to be “The One.” How can you do that with a resume that looks off center? Or has bad margins or hard-to-read fonts? You can’t.

So—

Here’s how to format a debt collector resume template:

Include these resume parts :

Header: your name and contact information .Summary: a short elevator pitch for your resume.Experience: your best debt collector successes.Education: list your degree and relevant classes.Skills: target them to the position’s needs.Other sections: if you have an FDCPA certification or you speak another language, add it.Should you use the functional resume format? See our guide: How to Pick the Best Resume Format

2. Add Experience to Your Debt Collector Resume You don’t need 10 years of experience in a debt collector resume. Even if they say 2+ you probably won’t need it. But there’s a right way and a wrong way to list your work history on a resume . To get the interview, reach back into your past. Find times you did the duties in the job ad.

To target your resume :

List your current or newest job title . Add the company name and working dates. Include a short debt collector job description. Write as many as 6 bullet points, with fewer in old jobs. Use the PAR (Problem-Action-Result) formula to add accomplishments that fit your skills. See these debt collector resume samples:

Debt Collector Job Description for a Resume Right Experience

Debt Collector

Zap Asset

July 2018 to Jan 2020

Key Qualifications & Responsibilities

Performed first party collections by making at least 70 calls per day on an automated dialer. Fielded 170–200 calls daily. Assisted borrowers over the phone via 3rd party to negotiate repayments. Exceeded monthly goal with over $35,000 collected per month. Helped customers with money management and payment plans. Key Achievement:

Awarded annual bonus for meeting 100% of financial goals in 2018 and 2019.

Wrong Handled calls daily from different clients. Responsible for helping customers reinstate their loans. Handled management of consumer accounts and kept track of payment arrangements. Provided customer service and maintained integrity.

Example #1 is paid-in-full. It looks sharper, for one thing. But it also has impressive resume achievements . Those numbers like 70, 200, and $35,000 will make employers say, “I’m looking at a pro.” But that bad resume example could be copy-pasted from online. There’s nothing in it that relates to you.

In an entry-level resume , use achievements from non-debt collector jobs. Maybe you’ve never been an account collector. But you’ve made phone calls, worked with team members, and used communication skills. Find high-impact moments that prove it.

See these entry-level debt collector resume examples:

Entry-Level Debt Collector Resume Samples [Experience] Right Call Center Agent

Arise Balance

July 2015 to July 2016

Fielded 120-140 inbound calls daily in a busy parts department. Maintained monthly quality control average of 95%. Made 100+ recommendations daily according to customer needs.

Wrong Handled the issues requested by the customers via phone. Responsible for handling calls daily to ensure high-quality customer service. Helping customers according to their needs.

Okay. Example #1 shows someone who’s good on the phone. She cares about her work. She has customer service skills. But—that second applicant is a coin toss. She “handled issues.” She was “responsible for” calls.But she may have had a hard time talking on the phone. We don’t know.

Entry-level candidates can also use experience to prove transferable skills. Those are skills like leadership or problem solving.

Pro Tip: Your resume design ’s first job? To get the info into the employer’s eyes. If it’s too flashy or creative, it won’t do that. Stick to a professional layout and let your achievements speak for themselves.

Making a resume with our builder is incredibly simple. Follow our step-by-step guide, use ready-made content tailored to your job and have a resume ready in minutes.

When you’re done, Zety’s resume builder ATS resume checker exactly how to make it better.

3. Make Your Education Section Count Debt collection isn’t rocket science. But your bill collector resume still needs an education section. But use it to prove skills. If you don’t, it’s like having a $600 Herman Miller Aeron and sitting on a kitchen chair instead. When listing a degree on a resume , start with your school name, but add achievements.

See this debt collector resume example:

Debt Collector Resume Example [Education] Right Education

Associate Degree in Communication

University of Oklahoma

2011-2015

Pursued a passion for mass communications. Used interpersonal skills to grow attendance in the school cycling club 30%.

Why does that education section drop the mic? Because it’s short, but it still manages to prove some skills.

Pro Tip: If you’re entry-level, consider adding relevant coursework to your resume . List it in a line or two, with classes like public speaking or accounting.

Want to put a scholarship on your resume? See our guide: How to Put Your Education on a Resume

4. Put the Right Skills in Your Debt Collector Resume You could just copy-paste a list of debt collector skills into your resume. But that won’t get your phone to ring. That hiring manager—we’ll call her Kelly—wants to see the skills she advertised in her job description. If your resume proves those are your skills, she’ll stop dozing off and notice you.

So—

Start with this list of skills for debt collector resumes:

Debt Collector Resume Skills (Hard Skills) Record Keeping Interest Calculation Bank Account Management MS Excel MS Office Skills QuickBooks Month-end Close Accounts Receivable (AR) Accounts Payable (AP) Payroll Debt Collector Skills (Soft Skills) But—

Here’s how to pick the right debt collector skills:

Read the job ad. Circle the soft skills and hard skills you find there. List your debt collector skills on a piece of scrap paper. Note the skills in the ad that are also on your scrap paper. Those are your resume keywords . Add them to your resume skills list. Use your bullet points to prove you helped your company with them. See this debt collector resume example:

Say the job description calls for state law knowledge , supervising , and customer service .

Debt Collector Resume Examples [Skills] Right Handled claims from all 50 states and applied specific state laws and rules. Supervised a group of more than 15 collectors.Followed strict guidelines providing 100% customer service . Managed a file of over 3,000 delinquent medical accounts.

Debt Collector skills on a resume like that will get your job search out of hock. The achievements are top notch. They prove the right skills. Plus, they add numbers like 15, 100%, and 3,000. Finally, each bullet starts with resume action verbs like followed or managed. It’s riveting.

Soft skills work no matter what industry you’re in. See our guide: +30 Best Examples of What Skills to Put on a Resume

5. Add Other Sections to Your Debt Collector Resume Experience and education count for a lot in a debt collector resume. But they’re not everything. A National Collector Certificate or fluency in Spanish can catch the manager’s eye. Additional resume sections show you’ve got skills to spare. Add them for a solvent application.

Choose from:

Resume Licenses & Certifications Several institutions will train you in debt collection techniques. If you’re experienced, you don’t need them. But if you’re entry-level, a cert can show you’ve got at least a little training.

Languages on a Resume The firm’s customers or borrowers may speak Italian, Spanish, Chinese, or French. Do one or two informational interviews to see if they speak the same language you do. If so, list it on your resume.

Professional Associations Associations like ACA International can get a better judgement for your resume. They prove you take your work seriously.

Resume Volunteer Work Do you walk dogs regularly for a nearby animal shelter? Make chowder on Sundays in a soup kitchen? Volunteering shows you don’t just sit around liking things on Facebook when you’re off the clock.

Conferences If you’ve attended DCS 2024 or another industry conference, you can add that to your resume. Employers will know you’re up-to-speed on trends, techniques, and regulations.

Awards and Honors Nobody gives an award for the best debt collector on the planet. But regional and company awards for meeting quotas can make your resume shine.

See these debt collector resume samples:

Debt Collector Resume Examples [Other Sections] Right Member, National Communication Association

Helped arrange inter-university speech competition. Recruited 15+ volunteers for multiple events. Freelance

Worked on personal freelance projects for 20+ customers. Provided voice-over for a local TV ad.

Pro Tip: Avoid typos like the plaque! One bad typo on a bill collector resume can show employers you cut corners. Typos are the #1 resume mistake that disqualifies job seekers.

6. Write a Debt Collector Resume Objective or Resume Summary Nightmare—you spend 10 hours writing the perfect debt collector resume. Then nobody calls. The culprit? You didn’t write a career summary for your resume. The summary is like the beginning of a call script. It tells employers why they shouldn’t press the end call button.

Here’s how to write a career summary :

Start with an adjective like effective or good-natured. Add your title (debt collector). List your years of experience. (1, 4+, 5) Share your goal for the position (speed repayment). Add the organization’s name. Include your best debt collector accomplishments. See these bill collector resume examples:

Debt Collector Resume Summary Right Effective debt collector with 4+ years of experience in negotiating and payment processing. Seeking to speed repayment of outstanding debts owed to Drive Credible. At Zap Asset, processed 160+ calls a day with 12% higher success rate than company average.

Wrong Competent debt collector with extensive experience in helping businesses obtain payment from debtors. A dedicated individual with amazing communication skills and excellent customer service skills. A team player and a pro at individual performance.

Stay with me, because those don’t look so different. But one will work, and the other will get a dropped connection. The details in example #1 show you can do the job because you’ve done the job. But you might have got example #2 from an article online. It could be anyone, including Joe Dirt.

In an entry-level debt collector resume, write a career objective . That’s supposed to be where you talk about your goals. Don’t do it! List successes from non-debt-collector jobs. Or add achievements from your business degree or your creative writing degree. But be specific—make it personal.

See these examples:

Entry-Level Debt Collector Resume Objective right Good-natured debt collector with experience in MS Excel and record-keeping. Seeking to slash past-due times at Summit Cash. Excellent customer communication skills. At Arise Balance, handled 120+ inbound calls daily, ensuring quality customer service.

Wrong Entry-level debt collector with updated knowledge of inbound and outbound calls and customer service. Knowledgeable in all aspects of customer relationships. Skilled in professionally managing teams and helping companies to prosper. Excellent in communicating with customers and with the team.

Argh! That second example is just a lot of words. How do we know you’ll live up to them? I’ll tell you how. We’ll know because you’ll delete it and write one more like example #1. It draws a perfect portrait of your most hirable traits.

Keep your resume short. See our guide: Should a Resume Be One Page? (And How to Make It Fit)

7. What About a Debt Collector Cover Letter? Do you really need a cover letter with a debt collector resume? Like air. We know from our hiring statistics report that half the hiring managers out there won’t read resumes without letters. (They look like spam.) Since you don’t know which half you’re working with, it’s best to write the letter.

To write your cover letter:

Choose the format of your cover letter first. Use the manager’s name as an easy attention-getter. Write a solid and engaging first paragraph for your cover letter . Use the second paragraph to show you’ve got the job duties dialed. Put an irresistible offer in your cover letter closing . Pro Tip: Did you know you can list your salary requirements in a cover letter ? Just be careful. Do your research first so you don’t come in too high (or low)!

See our guide: How To Write A Cover Letter in 8 Simple Steps

Plus, a great cover letter that matches your resume will give you an advantage over other candidates. You can write it in our cover letter builder here.

See more cover letter templates and start writing.

Key Takeaway Here’s a recap of how to write a debt collector resume:

Format your debt collector resume template in reverse-chronological order. Track down the right debt collector skills in the online job description. Create your experience section first. Use the PAR formula to customize your bullet points like an in-person phone call. Add personal achievements to your education section. Include “extra” resume sections for a National Collector Certificate or foreign languages you speak. Write a debt collector cover letter for an asset-heavy application. That’s it! Now, we’d love to hear from you:

What’s the most frightening part about writing a bill collector resume? Is it too hard to find the right transferable skills to list? Do you feel like your cover letter is too salesy? Let’s chat below in the comments, and thanks for reading!